Teach in a U.S. School

Overview

Greenheart Exchange’s Teach USA program connects enthusiastic, highly-qualified international teachers with U.S. host schools to promote cultural understanding and public diplomacy.

The purpose of the Teach USA program is to promote interaction and enhance mutual understanding between U.S. and international teachers. Participating teachers are placed in a K-12 host school for 1-3 years and teach a wide range of subjects. During this program, teachers can expect to sharpen their professional skills and take part in cross-cultural activities within their schools and local communities.

Greenheart Exchange provides two (2) program options:

- Self-Placed (SP): placements are arranged directly between the teacher and a Teach USA approved host school, supplemented by Greenheart Exchange’s sponsorship.

- Best Practices for Host School Approval:

- If you are a self-placed teacher with an official offer and/or Letter of Intent, ensure your host school completes the host school application immediately; all new host schools must be approved by Greenheart Exchange prior to an official placement approval.

- To assist in locating an accredited host school in the U.S., we recommend a registry such as Cognia. There are several accreditation agencies available to host schools. Keep in mind accreditation will vary school to school. Recognized by state does not satisfy proof of accreditation. Confirm with your host school, prior to signing an employment offer letter or contract, that they are in fact accredited and are an approved host school per Greenheart’s guidelines.

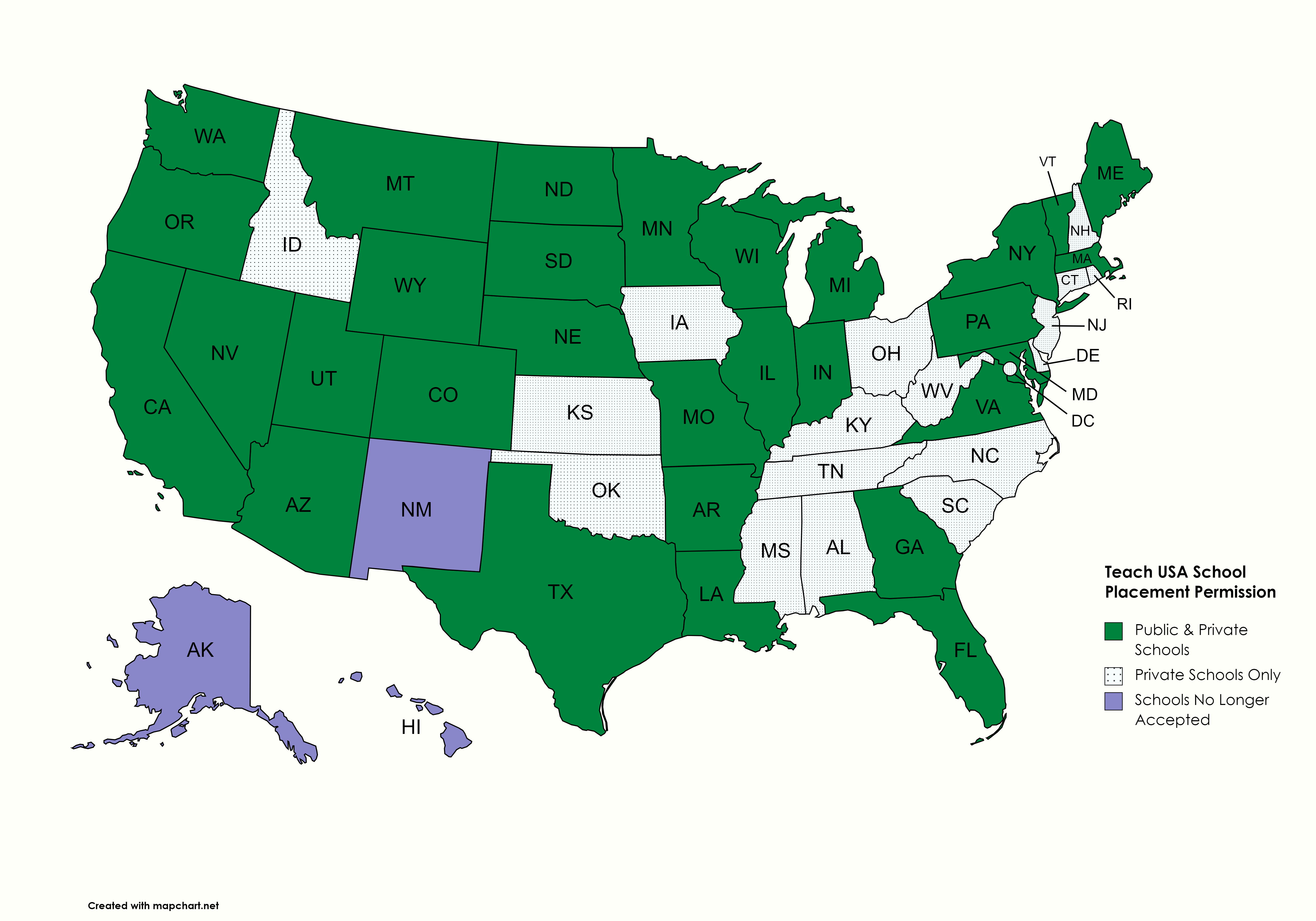

- See Greenheart Exchange’s MAP for U.S. states Greenheart is authorized to place in public schools for international teachers. Note that restrictions per state may apply and may be amended at any time.

- If your host school is not approved, your school representative will need to submit a School Inquiry Form.

- Full Program (FP): placements are facilitated by Greenheart Exchange Teach USA, matching accredited host schools with a qualified, experienced teacher.

**** PLEASE NOTE: Application Period is closed for the 2024-25 Academic Year. ****

Eligibility Evaluation for 2025-26 will open in November 2024.

Please see our Program Deadline section for further information.

Eligibility

All Teach USA applicants must:

- Meet the qualifications for teaching at the primary or secondary levels in schools in their country of nationality.

- Have a degree equivalent to a 4-year U.S. bachelor’s degree in Education or the academic subject field in which they intend to teach.

- Have a minimum of 2 years teaching or related professional experience.

- Satisfy the teaching eligibility standards of the U.S. state in which he or she will teach, including any required criminal background checks.

- Be of good reputation and character.

- Agree to come to the U.S. as a full-time teacher of record in an accredited primary (including pre-kindergarten) or secondary school.

- Be proficient in English. Teachers will be interviewed in English to assess verbal ability and comprehension.

- Be working as a teacher at the time of application.

Applicants NOT working as a teacher at the time of application must:

- Meet the qualifications for teaching at the primary or secondary levels in schools in his or her home country (including pre-kindergarten).

- Have at least two years of full-time teaching experience within the past eight years.

- Have completed an advanced degree (in Education or in the academic area he or she intends to teach) within 12 months of his or her application submission date for the program

- Have a completed Foreign Credential Evaluation (FCE) prior to interviewing with a Greenheart Exchange host school.

Greenheart Exchange partners with a third-party entity, offering discounted rates to our applicants. For more information, please contact the Teach USA team.

BridgeUSA Program

The Teach USA Program is part of the US Department of State’s BridgeUSA programming.

- The US Department of State administers 15 categories of the BridgeUSA Program

- The BridgeUSA Program provides international candidates an opportunity to gain valuable work and study experience in the U.S.

- The J-1 Teacher visa is a 3-year exchange visa for international teachers coming to the U.S. to teach, which can be extended 2 years for 5 years total

- Teachers are required to organize 2 cross-cultural activities (CCA) per year with their host school and local community

Greenheart Exchange is a Department of State (DOS) designated Exchange Visitor Program J-1 visa sponsor for many BridgeUSA programs, such as:

- Teacher

- Secondary School (High School Programs Department)

- Intern

- Trainee

- Summer Work Travel

The Department of State

This program is formally administered through the US Department of State through the Bureau of Educational and Cultural Affairs (ECA).

The US Department of State

- Creates program regulations and ensures sponsors, participants, and schools are compliant with the program rules

- Communicates with sponsors to ensure the health, safety, and well-being of the participants

- Approves program placements, extensions, and provides sponsors with DS-2019 forms for participants seeking J-1 visas

Greenheart Exchange’s Role as Visa Sponsor:

- Greenheart Exchange is your J-1 visa sponsor while you are in the U.S.

- Greenheart Exchange approves, places, and monitors international teachers in U.S. schools with help from our overseas partners

- We provide 24/7 program support to all teachers on our program in order to ensure health, safety, and well-being

- We work with host schools to guide you through school interviews, visa interviews, and arrival logistics to the U.S.

Fees

Fees (as of January 2024 – note: program fees change from year to year and are determined at the time the service is provided) Greenheart’s Program fees on the Teach USA programs are variable and depend upon program type, program length, and whether you are a direct applicant to Greenheart or an applicant through one of our contracted partners.

Program Fees

Fees Amount Paid to Greenheart 1-Year Program fees $2,275-$3,760 Greenheart Exchange Annual Program Renewal fee $1,900 Greenheart Exchange J-2 Dependent Annual Administrative fee $450 Greenheart Exchange Sending Partner fees $965-$10,800

See potential fees by recruitment country hereThird Party Partner - Greenheart Program Fees include the following:

- J-1 Visa Sponsorship (DS-2019 form)

- Pre-Departure Virtual Orientation

- Discounted Foreign Credential Evaluation (FCE) services

- 24/7 in-country support from Greenheart Exchange

- Accident and Injury Insurance coverage for the duration of the program upon arrival (J-1 only)

- Emergency medical evacuation insurance provided for the full program length (J-1 only)

- Placement with an approved and accredited U.S. Host School (Full Program)

Miscellaneous non-refundable fees to anticipate:

Fee Name Amount Paid To Application Fee $200 Greenheart Exchange Flat Rate Courier Fee $60 Greenheart Exchange State Teaching License / Licensure Exams $100-$200 Specific State Authority Criminal Background Check $35-$165 Background Check Agency Lost/destroyed DS-2019 Replacement $50 + shipping Greenheart Exchange Foreign Credential Evaluation (with Spantran) $150-$220 Spantran Change of Host School Fee $300 Greenheart Exchange Year 4/5 Program Extension Application Fee $500 Greenheart Exchange Visa related fees:

Fee Name Amount Paid to SEVIS fee $220 U.S. Department of Homeland Security Visa Interview Fee $185 U.S. Embassy or Consulate Reciprocity fee Varies based on the country of citizenship U.S. Embassy or Consulate Cancellation Policy:

Cancellation Period Cancellation Fee Visa Denial Fee Cancellation request received at least 28 days before DS 2019 start date $500 $250 Cancellation request received 27-1 day(s) before DS 2019 start date $1000 $500 Cancellation request received on or after DS 2019 start date Entire program fee Entire program fee Teaching salaries and living expenses in the United States Teachers on this BridgeUSA program receive a full-time salary from the host school which enables the participant to pay for living expenses in the U.S. The expenses anticipated include, but are not limited to: housing, food, and leasing or purchasing a car. Teaching salaries and living expenses in the U.S. vary based on a number of factors such as years of teaching experience, location, family size, and lifestyle choices.

*Salary Tax Withholding: while being placed in a USA school you will need to account for three different categories of taxes as well as several possible deductions from your pay:

Tax Amount Federal tax: The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household. IRS.gov lists seven rates for a single taxpayer in 2023: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. State Income taxes Varies significantly from state to state. Typical range from 0%-13% depending on location. *FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. FICA mandates that separate taxes be withheld from an employee's gross earnings: 6.2% Social Security tax, withheld from the first $147,000 an employee makes in 2022. 1.45% Medicare tax, withheld on all of an employee's wages.

**First-year teachers may be eligible for a FICA exemption for up to two calendar years, based upon prior presence in the U.S*All tax information is subject to change and highly dependent on location, income, elective deductions, and personal financial circumstances. Participants will need to check the IRS and state government websites for the most up-to-date tax and filing information.

Many participants choose to seek professional tax preparation assistance for any years on-programTypical tax preparation / personal accounting services range from $80-$250 Elective employee benefits such as life insurance, 401k or other retirement accounts These deductions are typically only made if the employee elects to take part in a particular plan or service and common range from 1% to 15% of pre-tax income. Health Insurance premiums for medical coverage plans offered through host school Greenheart program fees include insurance coverage from arrival to program completion meeting Department of State requirements, but many teachers choose to later join their employer’s plan for more comprehensive coverage. In those cases, where a participant has secured their own insurance that meets program regulations and chooses to opt-out of the Greenheart arranged plan, a partial, pro-rated refund of the program fee may be made after sponsor review and approval.

Typical deductions for medical insurance through an employer:

HMO plan: $50+ per paycheck

PPO plan: $60+ per paycheck

Dental Benefits: $40 - $100+ per paycheck

*Participants are recommended to review a summary of benefits offered by their host schoolUnion Dues for teachers in a school where employees are covered under a collective-bargaining agreement Amounts vary and may not apply to all host schools. 1%-3% per paycheck is typical J-2 Dependent Insurance coverage for teachers bringing family on program. Estimated $400-$3,000+ per year depending on provider. Most participants choose to add dependents to their host school plan It is important that you plan carefully for all expenses prior to coming to the U.S.

Expenses Potential Costs *Housing Rent varies by location and size of the unit: $750 to $5,000+ per month *Transportation Public transportation: free to $220 (monthly pass) *Groceries $100+ per week *Personal expenses $500-$2000+ depending on location and family size *Expenses in the USA can differ dramatically for each community; you can utilize a cost-of-living calculator to understand potential expenses. Sample calculators include:

Forbes

BankRate

NerdWalletExamples (for estimation purposes only; actual expenses will vary):

Example 1: Family with 2 small children and 1 stay-at-home parent living in the Phoenix suburbs:

Expense Monthly cost Rent for 2-bedroom apartment $1,680 Energy bill $180 Phone (2 lines) $120 Cable/internet $80 Car (fuel, maintenance, insurance) $380 Car payment $300 Subsidized school health insurance $240 Groceries $800 Travel, entertainment, meals out $100 Personal expenses $250 Total $4,130 * For a similar family but with two working parents, estimate an additional $1,000-$3,000 for childcare expenses

Example 2: Single teacher living in Chicago who enjoys nightlife and dining out 2x per week:

Expense Monthly cost Rent (sharing with one roommate) $1,100 Energy bill $55 Phone $80 Cable/internet $35 Transportation (monthly pass for bus/train) $80 Subsidized school health insurance $75 Groceries $350 Travel, entertainment, meals out $450 Personal expenses $100 Total $2,325 Teachers should expect to wait several weeks or more for their first paychecks. Greenheart Exchange recommends teachers bring a minimum of $3,500 with them to cover initial expenses, such as first month’s rent and rental deposits, a car down payment, driver’s license and Social Security application fees, and other initial expenses.

- Greenheart Program Fees include the following:

Sending Partner Fees

Sending Partner Fees

Sending Partner Primary country of recruitment Potential Fees in USD Worldwide Cultural Exchange SOC Argentina $1,470 Phoenix Tree Publishing, Inc China $10,000 OAK Let's Go Colombia $4,755 Grace International Exchange Dominican Republic $1,980 Travel Empire Limited Ghana $1,720 Besor Associates Nigeria $965 Fundacion IE Intercultural Experience Paraguay $4,755 Prime Opportunities Philippines $2,743 Teach-USA, LLC. Philippines $2,840 American Collegiate Adventures Philippines $2,370 Jobs Connect USA Philippines $4,190 Education Exchange Partners Kenya, Mexico, Venezuela, Colombia, India, Philippines, Peru $3,000 Foreign Cultural Exchange (FCEC) Philippines $2,500 Mialakai Group USA, LLC Philippines $4,220 Trades And Professions, Inc. Philippines $6,800 Regulations

The BridgeUSA Program fosters global understanding through educational and cultural exchanges. All exchange visitors are expected to return to their home country upon completion of their program in order to share their exchange experiences.

Greenheart Exchange is committed to making sure that our teachers are safe during their time in the U.S. The information on this page will provide you with up-to-date program regulations and expectations. Please contact us directly with any questions.

Department of State Resources

- BridgeUSA Program Regulations: Specific BridgeUSA Teacher Program regulations can be found at 22 C.F.R §62.24

- BridgeUSA Program Welcome Brochure: The Department of State provides a brochure for teachers.

- BridgeUSA Program Website: The Department of State’s official website for the BridgeUSA Program provides a variety of resources.

- Guidance Directive: The Department of State may issue Guidance Directives to J-1 Visa sponsors at any time. All Guidance Directives are publicly available. The following Guidance Directives pertain to the BridgeUSA Program:

Greenheart Exchange Notification Requirements

Teachers and host schools are required to notify Greenheart Exchange of the following situations:

- Teachers must check-in with Greenheart Exchange and provide their housing address within 72 hours of their arrival to the U.S.

- Teachers must check-in with Greenheart Exchange every 30 days throughout the duration of their program.

- Teachers must notify Greenheart Exchange of any changes in their housing address within 48 hours of the change.

- There is a concern for the teacher’s health, safety and well-being.

- The teacher’s DS-2019 Form is lost, stolen, or damaged.

- The teacher leaves, quits, or is fired from the host school for any reason.

- The teacher intends to travel internationally.

- The teacher has issues processing a Social Security card application.

- The teacher has issues with wages or taxes.

- The teacher has issues with their job duties.

- The teacher is not abiding by the rules and regulations set forth by their sponsor, the U.S. Department of State and by their host school, in the form of contracts, employee handbooks, etc.

Exchange Visitor Rights

All Exchange Visitors are entitled to the same legal protections as U.S. residents and citizens. Please review the following resources regarding rights and protections of participants on the Teacher Exchange Program:

- Know Your Rights Pamphlet: This Department of State pamphlet provides an overview of basic workers’ rights in the U.S. This pamphlet can be found in a variety of languages.

- Fair Labor Standards Act: Teachers are protected under the Fair Labor Act (FLSA). Host schools are required to adhere to all FLSA regulations. Please review the FLSA Compliance Assistance website for more information. Additional resources are listed below:

I-9 Form: Employment Eligibility Verification

- All host schools are required to ensure proper completion and retention of the I-9 Form on the teacher’s first day. U.S. Citizenship and Immigration Services provides a variety of resources for host schools on their website.

- Social Security Number: Teachers will need to apply for a Social Security card (if they have never been issued one). Host schools should be aware that the Social Security card application can take up to 6 weeks, and teachers can begin their program during this time. Please see the additional resources below:

U.S. Tax Withholdings

Teachers are required to be on regular payroll and must complete Form W-4 at the start of their program. Teachers are required to pay federal, state, and local (if applicable) income taxes and are exempt from paying FICA and FUTA taxes. Please review additional resources below:

Annual U.S. Tax Returns

Host schools must provide W-2 forms to teachers in-line with Social Security Administration requirements. Teachers are required to file an individual tax return in-line with Internal Revenue Service requirements. Please review the additional resources below:

Program Timeline

Application Deadline for Academic Year 2024-25: closed.

Eligibility Evaluations for Academic Year 2025-26: opens November 2024.

U.S. Arrival Dates: July – September

U.S. School Year: August – June

Here’s where to Check your eligibility now

Thank you!

FAQs

How do I apply for the Teach USA program?

It’s simple! Begin by clicking the “Get Started” button. Greenheart Exchange will review your submission and contact you shortly.

Who pays the Teach USA program fees?

Participants are responsible for paying all fees associated with the Teach USA program. However, Greenheart does encourage schools to help pay for program fees if funding is available.

What type of salary will I earn as a teacher?

Teach USA teachers earn the same salary and benefits as their American counterparts. This is a requirement for all host schools in the Teach USA program.

How do I become certified to teach in my U.S. host state and school?

Teacher certification for international teachers is different state-by-state. The first step for all teachers is to undergo a Foreign Credential Evaluation (FCE). Greenheart Exchange offers a unique discount for our teachers to expedite their FCE and save money in the process!

What types of host schools am I eligible to teach at (public, charter, private, international)?

Greenheart Exchange works with all types of accredited K-12 schools that meet or exceed state standards, provided they are supportive of international teachers and cultural exchange.

What is the timeline of the Teach USA program?

The U.S. school year typically runs from August to the following June.

Can my spouse or children (dependents) accompany me to the U.S.?

Yes! Spouses and children under 21 are eligible for sponsorship on a J-2 visa. Greenheart recommends that your family join you in the U.S. only after you have arrived at your placement, began teaching, and secured housing. Additionally, J-2 children can attend school in the U.S.

Can my spouse work on a J-2 visa?

Dependents may apply for an I-765 from the U.S. Citizenship and Immigration Services (USCIS) to obtain an Employment Authorization Document (EAD) to work throughout the duration of their stay.

How long can I stay in the U.S.?

Teachers can stay up to 3 years and may apply for an extension of 2 years for a possible total of 5 years.

During the 3 year program time frame, teachers must renew annually in February.

Teachers wishing to extend beyond the 3 year program must apply in December-January of their third year.

Why Greenheart Exchange?

Greenheart Exchange has been a J-1 visa sponsor for many years, and there are advantages to Greenheart being your visa sponsor:

- 35 years of experience with cultural exchange programs

- Hands-on support every step of the way

- 24/7 emergency phone number to reach a staff member at any time

- Pre-departure Webinar before you leave

- We are a non-profit, mission-based organization

- Continued support throughout your time in the USA

We also have some unique offerings to our Greenheart Exchange teachers and alumni!

Greenheart Grants

Greenheart Grants are funds awarded to Greenheart teachers to use for community development projects in their host or home country. A Greenheart Grant is the opportunity to create, improve, or maintain an impactful, community-focused project abroad or at home. Grant funds could be applied to supporting women’s cooperatives, schools, community centers, or health clinics, for example. Grant winners will be featured on our website, social media, and blog. You can see a past Teach USA grant recipient project here.

Greenheart Global Leaders Conference

Each August Greenheart offers full-ride scholarships to over 40 alumni to attend our annual conference in Washington, DC. Participants even get a chance to advocate for cultural exchange in a presentation to the US Department of State. You can see more about what GGLC is and what you could do at the conference here.

Blog

Check out some of our latest blog posts.